Establishing offshore companies in Dubai is considered one of the most prominent global destinations for establishing offshore companies, as it provides an ideal environment for companies wishing to benefit from tax privileges, advanced infrastructure, and strategic location. Establishing an offshore company in Dubai gives investors many benefits that make Dubai an ideal choice for setting up and running a business.

Dubai, as part of the United Arab Emirates, has a flexible and advanced economic system that supports innovation and growth. Establishing offshore companies in Dubai allows companies to benefit from tax facilities, as offshore companies can operate without having to pay taxes on income or profits, which increases Dubai’s attractiveness as an investment destination. In addition, local laws ensure the protection of investors’ rights and the confidentiality of financial information, which enhances confidence in the business environment.

In terms of infrastructure, Dubai offers world-class infrastructure that includes seaports, modern airports and a developed road network, which facilitates business operations and accelerates the movement of goods and services. The free zone in Dubai, such as the Jebel Ali Free Zone, also provides integrated facilities and services that support the establishment of offshore companies, including equipped offices, storage spaces, and advanced logistical services.

Establishing an offshore company in Dubai requires compliance with a range of local laws and legislation aimed at regulating business and ensuring legal compliance. Investors can benefit from government support and specialized institutions that provide legal and administrative consultations to help establish companies easily and effectively. This includes choosing the appropriate type of company, preparing legal documents, and obtaining the necessary licenses and permits.

Establishing offshore companies in Dubai

What are offshore companies?

Offshore company formation in Dubai is a type of legal entity that is established in countries or geographic regions different from where its founders or owners reside, and is often established in tax havens that provide legal and tax advantages to investors. These companies are used for a variety of purposes, including international expansion, wealth management, tax planning, and asset protection. Offshore companies are known to be registered in jurisdictions that offer favorable tax policies and flexible regulations, making them an attractive option for global corporations and wealthy individuals.

One of the most important advantages of establishing an offshore company is the benefit of favorable or non-existent tax regimes in some jurisdictions, which reduces the tax burden on profits. Many jurisdictions provide strict laws to protect the privacy of shareholders and directors, protecting the identity of company owners and ultimate beneficiaries. This confidentiality makes offshore companies an effective means of managing wealth and protecting assets from lawsuits or financial claims.

Offshore companies provide a means of protecting assets from political and economic fluctuations in countries of residence, providing an additional layer of financial security. Global companies use these entities to efficiently implement their international plans, including expanding into new markets or managing cross-border operations. Offshore companies also provide access to international capital markets and facilitate cross-border business transactions.

However, it should be noted that the establishment and use of offshore companies must be done in a legal and ethical manner. Companies and individuals who use these entities for illicit purposes such as tax evasion or money laundering may be exposed to serious legal risks. Therefore, it is necessary to comply with local and international laws and ensure transparency in financial operations.

Characteristics of offshore companies

Offshore companies have a set of unique characteristics that make them an attractive option for companies and individuals wishing to benefit from various financial, legal and regulatory advantages. Establishing a company in Dubai Offshore is usually done in jurisdictions known as tax havens, as they provide flexible laws and easy tax policies. Below we take a look at the most prominent characteristics of offshore companies:

1. Tax liens:

One of the most important characteristics of offshore companies is the benefit of low or no taxes. Many jurisdictions that host offshore companies do not tax profits, capital gains, or foreign income, which helps companies reduce their tax burden and increase financial returns.

2. Confidentiality and privacy protection:

Offshore companies provide a high degree of confidentiality and privacy protection to shareholders and directors. Many jurisdictions have strict laws that protect the identity of business owners, making it an ideal choice for individuals and businesses wanting to keep their financial information confidential.

3. Asset protection:

Offshore companies can be used as an effective tool to protect assets from legal risks or lawsuits in the country of residence. By registering assets in the name of an offshore company, individuals can protect their wealth from financial claims and legal disputes.

4. Organizational flexibility:

Offshore companies have flexible organizational structures that facilitate the establishment and management of businesses. The corporate structure can be customized to suit individual business needs, whether in terms of number of shareholders, type of shares, or management system. This flexibility makes it suitable for a variety of trading and investment activities.

5. Ease of establishment:

The process of establishing offshore companies is usually quick and simple compared to the complex procedures in some countries. Many jurisdictions have simplified and fast company registration procedures, enabling companies to start operations quickly and efficiently.

6. Access to international markets:

Offshore companies allow companies and individuals to access international capital markets easily. These entities can be used to implement international expansion plans, manage cross-border operations, and take advantage of business and investment opportunities around the world.

7. Low operating costs:

In many tax havens, the operating and management costs of offshore companies are relatively low. This includes registration costs, annual fees, and other management expenses, which helps improve the financial efficiency of the company.

8. Intellectual property protection:

Offshore companies can register intellectual property rights, such as patents and trademarks, in jurisdictions that provide strong protection for these rights. This helps protect innovations and intellectual assets from violations and legal disputes.

Validity of offshore companies

Offshore companies, or offshore companies, are legal entities established outside the country of residence of their founders or owners, and are usually registered in jurisdictions known as tax havens. The validity of offshore companies refers to the legal, regulatory, and practical aspects of these companies and how to use them legally and effectively. Establishing and managing an offshore company comes with a range of benefits, but it also requires compliance with a range of laws and regulations to ensure transparency and legitimacy.

Legal aspects of offshore companies

Offshore companies are legal in most jurisdictions if they are established and managed in accordance with local and international laws. Many countries and tax havens provide a flexible legal framework that allows these companies to be established quickly and efficiently. Local laws in these areas often offer tax advantages and privacy protections, making them attractive to investors. However, it is necessary to comply with international laws related to combating money laundering and terrorist financing.

Organizational advantages

Offshore companies have significant organizational flexibility, allowing the company structure to be customized to meet unique business needs. Companies can choose a shareholder structure that suits their objectives, as well as select the type of shares and appropriate management systems. This flexibility helps companies improve their operational and financial efficiency.

Transparency and responsibility

Although offshore companies provide a high level of privacy, it is necessary to maintain transparency and comply with international laws. Companies must provide accurate financial reports and comply with legal registration and reporting requirements. Failure to comply can result in legal penalties and fines.

Legal uses

Offshore companies can be used for many legitimate purposes, including tax planning, asset protection, and international expansion. These companies provide an effective means of protecting wealth from political and economic fluctuations in the countries of residence, and help in implementing international business strategies efficiently. By registering assets in the name of an offshore company, individuals can protect their assets from legal claims and lawsuits.

Challenges and risks

Despite their many advantages, offshore companies face challenges and risks related to compliance with international laws and reputational concerns. Companies must ensure compliance with international AML/CFT standards, and be prepared to cooperate with judicial authorities in the event of investigations. In addition, offshore companies may be exposed to reputational risk if they are associated with illegal or unethical activities.

Recent developments

Laws and regulations for offshore companies are constantly evolving, as governments and international organizations work to enhance transparency and combat illegal activities. These developments require offshore companies to stay up to date with legal and regulatory changes to ensure compliance and avoid legal risks.

Conditions for establishing offshore companies in Dubai

Dubai is one of the most prominent global destinations for establishing offshore companies, as it provides an encouraging investment environment and advanced infrastructure. Establishing a company in Dubai Offshore gives investors many benefits, including tax facilities, privacy, and asset protection. To establish an offshore company in Dubai, there are a set of conditions and procedures that must be followed to ensure compliance with local and international laws.

1. Choosing a suitable free zone

in Dubai. Offshore companies can be established in specific free zones, such as Jebel Ali Free Zone (JAFZA) or the Dubai International Financial Center (DIFC). Requirements and procedures differ slightly between these zones, so investors must choose the free zone that best suits the type and nature of their business.

2. Submitting the required documents

to establish an offshore company in Dubai. A set of documents must be submitted, including:

Establishment application form: You must fill out and submit the establishment application form for the selected free zone.

Passports: Certified copies of passports of all shareholders and directors.

Residential Address: Proof of residential address for all shareholders and directors, such as utility bills or lease contracts.

Business Plan: Submit a detailed business plan that explains the type of business activity and the company’s goals.

Bank Reference: A letter of reference from a reliable bank proving the good financial reputation of the major shareholders.

3. Appointment of a registered agent

Offshore companies in Dubai must appoint a registered agent approved by the competent authority in the free zone. The registered agent is responsible for submitting official documents and communicating with authorities on behalf of the company.

4. Minimum Capital

Capital requirements vary between free zones, but generally, there is no minimum capital required to establish an offshore company in Dubai. Capital can vary based on the type of business and free zone requirements.

5. Licenses and Permits

After submitting all required documents, the necessary licenses and permits must be obtained from the chosen free zone authority. This includes the commercial license that allows the company to conduct its business activity.

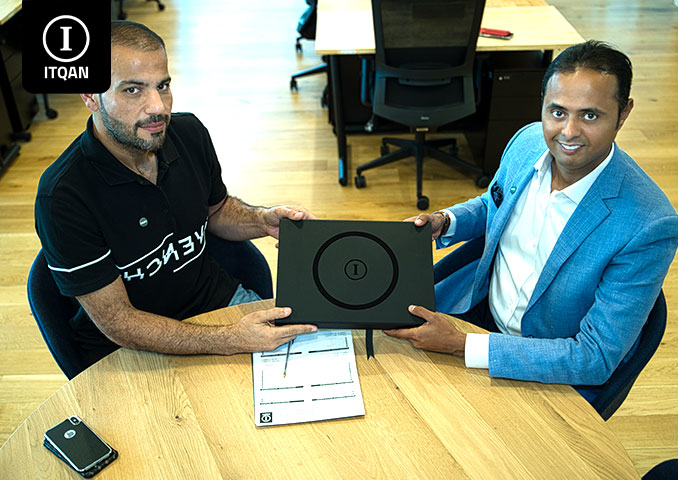

Our company’s role in establishing offshore companies in Dubai

In conclusion, establishing offshore companies in Dubai in cooperation with Itqan Company represents a strategic step towards achieving commercial and financial success. Thanks to the advanced investment environment and legal and regulatory facilities offered by Dubai, investors can benefit from tax advantages, regulatory flexibility and asset protection. By cooperating with Itqan Company, the incorporation process can be facilitated and compliance with all applicable laws and regulations can be ensured. This cooperation provides integrated support from specialized experts, which enhances the chances of success and making the most of the investment opportunities available in Dubai. Establishing an offshore company in Dubai in cooperation with Itqan Company can be the perfect start for achieving sustainable growth and expanding the business on a global level.

Frequently asked questions about establishing offshore companies in Dubai

What are the main benefits of establishing an offshore company in Dubai?

Establishing an offshore company in Dubai offers many benefits, including tax advantages, privacy and asset protection, regulatory flexibility, and easy access to international markets. In addition, Dubai has advanced infrastructure and strong government support for investment.

What are the documents required to establish an offshore company in Dubai?

Required documents include certified passports of all shareholders and directors, proof of residential address, incorporation application form, business plan, reference letter from a reliable bank, and any additional documents that may be required by the competent authority in the chosen free zone.

Is there a minimum capital required to establish an offshore company in Dubai?

There is no minimum capital requirement in most free zones in Dubai when establishing an offshore company. Capital requirements vary based on the type of business and free zone requirements.

What are the basic procedures for establishing an offshore company in Dubai?

The basic procedures include selecting the appropriate free zone, submitting the required documents, appointing a registered agent, obtaining the necessary licenses and permits, and opening a bank account. This is followed by an annual renewal process to maintain the viability of the company.

Can foreign investors establish an offshore company in Dubai?

Yes, foreign investors can easily establish offshore companies in Dubai. Dubai provides an encouraging environment for foreign investment, and allows foreign investors to fully own offshore companies without the need for a local partner.