Dubai Free Zone is one of the most dynamic and advanced economic zones in the world, providing an ideal environment for investment and business development. Located in the heart of the United Arab Emirates, this stunning region is a hub for global trade and innovation, with flexibility, operational efficiency and modern infrastructure that make it an attractive destination for businesses and investors from around the world.

Dubai Free Zone is a unique investment environment, with encouraging policies, flexible business laws, and smart financial legislation. This region is home to hundreds of international and local companies in various sectors, from financial services, logistics, technology and consulting to manufacturing and modern technology.

The Dubai Free Zone is characterized by the availability of many specialized economic outlets, which include free zones such as the Jebel Ali Zone, the Blue Mountain Zone, the Dubai Investment Zone, the Dubai Aviation Zone, the Dubai Internet Zone, and many others. These ports provide a unique business environment, characterized by tax reductions, customs facilitations, fast licensing, and sustainable government support.

It is also a hub for innovation and technology, hosting many research centers, technology institutions and startups. This area is home to international events and exhibitions, encourages cooperation and knowledge exchange between different sectors and promotes innovation and creativity.

In short, Dubai’s free zones are an unparalleled investment destination, combining flexibility, efficiency and innovation. It is a business incubator environment in which companies and investors flourish, and the cluster achieves Dubai’s continued growth and development. It is considered an attractive station for investors and companies wishing to benefit from the business opportunities available in the region. This free economic zone represents a gateway to international trade and contributes to strengthening the local economy and enhancing global trade exchange.

What are the free zones in Dubai?

Dubai is distinguished by the fact that there are many free zones in addition to many areas under construction, as the number of free trade zones in Dubai is 40. There are many people who have recently traveled to Dubai, especially the free zones in Dubai, as there are many free trade zones in Dubai. Benefits that differ from other places are not charged and are subject to full tax exemption laws. Plus, working with them is better than anywhere else, and it’s possible for a person to own the company without a sponsor. So if you are one of the investors who want to start doing business in Dubai and want to have a company in Dubai. All you need to use our company is the best company to start and prepare a business in the free zone. You can contact our company by calling the company number and get what you want as soon as possible.

Steps to establish a business in Dubai Free Zone

Establishing a business in the Dubai Free Zone requires following a series of steps and procedures. Here is an overview of the basic steps to setting up a business in Dubai Free Zone:

- Planning and Research: Before starting your business in Dubai Free Zone, you must conduct the necessary research and develop a detailed business plan. Determine the type of business you want to engage in and study the market and potential competition. It is also advisable to consult with business consultants or company establishment specialists in the region.

- Choosing a free sector: In Dubai Free Zone, there are several specialized free sectors that serve different activities such as logistics, technology, finance, manufacturing industries, etc. Determine the freelance sector that best suits your business and matches your requirements and future plans.

- Company establishment: Obtain a company license from the competent authorities in the Dubai Free Zone. You can choose between several company models such as the local company, the wholly foreign-owned company, the company owned by foreign investors, and the joint-stock company. The required documents must be submitted and the prescribed fees must be paid.

- Location Selection: Find a suitable location within Dubai Free Zone for your business headquarters. There may be multiple options regarding offices and commercial spaces that match your needs. You can negotiate with the specialized real estate companies in the area to get the best offer.

- Obtaining licenses and permits: Depending on the type of business activity, you may need to obtain additional licenses and permits from the relevant authorities. Licenses required may include building licence, business licence, health and safety licence, customs licences, among others. You should check the requirements for your business and application to obtain the appropriate licenses.

- Recruitment and Labor: If you want to hire employees for your business in the Dubai Free Zone, you will have to comply with local labor laws and provide a suitable working environment for employees. You may also need to obtain the necessary work permits for foreign employees if they are not UAE citizens.

- Compliance with financial legislation: You must comply with the financial legislation in force in the Dubai Free Zone. You may need to open a business bank account and meet financial reporting and tax requirements.

- Starting work: After completing all necessary procedures and licenses, you can start your business in the Dubai Free Zone and work on implementing your business plan.

The most important free zones in Dubai

In Dubai, there are several free zones, the most important and prominent of which are:

- Jebel Ali Zone (JAFZA): One of the largest free zones in the world, specializing in industry, trade and logistics, and home to more than 7,000 companies.

- Dubai Technology and Media District (DIC): Specializes in technology, media and creativity, attracting international technology companies and media.

- Dubai Business District (DIFC): A financial and institutional center that attracts international banks, financial and legal companies, and provides an advanced business environment.

- Dubai Customs District: Provides a favorable environment for companies specialized in import, export and customs clearance.

- Dubai Craft and Commercial Industries District (DICCI): Supports traditional and modern craft and commercial industries such as textiles and jewellery.

- Dubai Free Zone (DFZ): Provides a free environment for commercial and industrial companies with a focus on manufacturing and general trade.

- Dubai Aviation Zone (DAFZA): Specializes in aviation and logistics and attracts companies specializing in aviation and logistics services.

To establish a company in Dubai Free Zone , there are usually some basic conditions and procedures that must be followed. However, these conditions and procedures must be met by reviewing the requirements of the free zone in which you intend to establish and communicating with the competent authorities. Here is an overview of the conditions that may be required:

- Company type: You must specify the type of company you wish to establish in the Dubai Free Zone. Available options can include a limited liability company (LLC), a joint stock company, a branch of a foreign company, or a completely set aside company.

- Capital: The amount of capital required is determined according to the type of company you wish to establish. There may be minimum capital requirements. You must provide the specified capital and document it in appropriate ways.

- Activity licenses: You must obtain an activity license appropriate for the activity of the company you intend to establish. You should check the list of permitted activities in the free zone and ensure your business complies with it.

- Shareholders and Contribution: The identity of the company’s shareholders, their shares, and their financial contributions must be determined. There may be special requirements for the percentage of local shareholding and foreign shareholding in some sectors.

- Company name: You must select a name for the company that complies with local laws and instructions, and ensure that it is not repeated with the names of other companies.

- Contracts and documents: The contracts and documents necessary to establish the company must be prepared and signed, such as shareholding contracts, general contracts, and other required agreements.

- Office and address: An office address must be provided for the company in the free zone, and a temporary office can be used or the services of business centers available in the zone can be used.

- Registration procedures: Registration procedures must be completed and the necessary documents must be submitted to the competent authorities in the free zone, such as the Dubai Economic Development Department (DED) or the Dubai Free Zones Authority (DAFZA).

- Insurance: There may be requirements for property and civil liability insurance for the company. The minimum insurance required must be verified and the relevant procedures completed.

- Financial obligations: You must adhere to the financial legislation in force in the free zone. This may include submitting periodic financial reports and complying with local taxes and fees.

Establishing companies in the Dubai Free Zone

Establishing a business in free zones in Dubai is one of the things that many investors have been busy thinking about recently, as investing in free zones has become one of the most profitable projects that generate significant revenues for their owners, as free zones in Dubai have become special places, and consumers are becoming… More solid. In addition to the ease of commercial laws in free zones, various institutions and activities are not subject to labor laws imposed by the competent authorities on the rest of the local institutions. Anyone can own a business within the free zone without the need for a UAE partner or sponsor. There is also full tax exemption. In addition, there are no fees, and since the process of starting a business is one of the things that requires effort and good planning, it helps its clients start working in free zones and provides them with the most suitable equipment for the activity. So if you want to have a company in the best free zone, all you need to switch to our company is to have a great experience that will help you create the best companies.

The best company for establishing companies

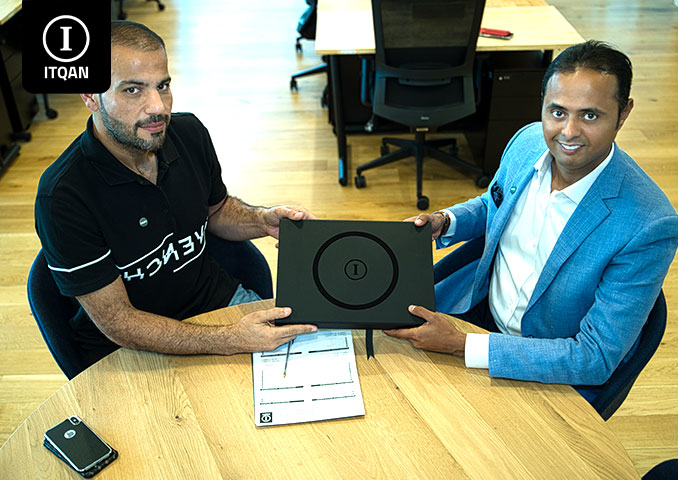

Itqan Company is one of the leading companies in the field of company establishment services in Dubai , and is the ideal choice for many investors and entrepreneurs seeking to establish new companies in the region. Itqan Company offers a comprehensive range of services that facilitate the establishment process and ensure that it runs smoothly and efficiently, making it the best choice for establishing companies.

- Extensive experience: Itqan Company has long experience in the field of company establishment in Dubai, which allows it to provide accurate consultations and reliable information about all aspects of company establishment.

- Integrated services: Itqan Company provides a variety of services such as registering companies, obtaining licenses, opening bank accounts, and legal and financial consultations, ensuring that all clients’ needs are met from one place.

- Customized solutions: Itqan Company works to provide customized solutions that suit the nature of each client’s activity, whether in free zones or outside them, ensuring that business goals are achieved efficiently.

- Effective communication: Itqan Company provides continuous support and effective communication with customers during all stages of establishment, which contributes to accelerating procedures and reducing any potential problems.

- Seamless experience: The comprehensive services provided by Itqan Company contribute to simplifying the process of establishing companies and avoiding complications, which saves investors’ time and allows them to focus on developing their business.

- Legal and financial support: Itqan ensures that all legal and financial procedures are done correctly and in compliance with local requirements, which helps avoid any subsequent legal or financial problems.

In short, Itqan Company is considered the ideal choice for establishing companies in Dubai thanks to its deep experience, integrated services, and the distinguished support it provides to customers.

Documents required to establish a company in a free zone

The documents required to establish a company in Dubai’s free zones vary based on the type of business activity and the type of company, but there is a set of basic documents that are often required in general. Here is a list of basic documents you may need to establish a company in a free zone:

- Passports: Original passports and copies of them for founders, directors and investors.

- Personal photos: Recent personal photos of founders and directors.

- Articles of Association and Articles of Association: The Articles of Association and Articles of Association of the company that define the company’s objectives and administrative structure.

- Submitting an application for a trade name: An application to register the company’s trade name, which must be unique and not previously used.

- Lease Contract: The lease contract for the company’s headquarters in the free zone, proving the company’s actual address.

- Business Plan: A detailed business plan that explains the nature of the business, goals, and growth strategy.

- Commercial activity details: Details of the commercial activity that the company will practice, including the type of goods or services.

- Legal powers of attorney: Legal powers of attorney from shareholders or founders if there are agents who submit the application on their behalf.

- Financial documents: Financial statements or proof of the financial capacity of the founders, such as bank statements.

- Industrial or commercial license: For activities that require special licenses, such as manufacturing or trade, the appropriate license must be submitted.

- Certificates of good standing: Certificates of good conduct from local or national authorities for founders and directors.

- Additional Approvals: Some activities may require additional approvals from relevant government agencies or regulatory bodies.

Advantages of Dubai Free Zone

Dubai Free Zone offers many advantages that make it a distinctive destination for businesses and investors. Here are some key advantages:

- Tax exemptions: Complete exemption from income tax and corporate tax, which reduces operational costs and increases business profitability.

- Full foreign ownership: It allows 100% full ownership of foreign companies without the need for a local partner.

- Ease of registration procedures: Fast and simple registration procedures, with support and assistance from local authorities to facilitate the establishment process.

- Advanced infrastructure: Free zones in Dubai provide modern infrastructure that includes offices, warehouses, and logistical facilities, which contributes to improving operating efficiency.

- Strategic location: A distinguished location that facilitates access to international markets, thanks to its proximity to the main ports and airports in Dubai.

- Facilitations in employment: ease in recruiting workers and hiring talent, while providing easy work visas and residence permits.

- Integrated support services: Various support services include legal consulting, accounting, and financial planning, which enhances the success of companies in the market.

- Advanced business environment: A business environment oriented towards innovation and growth, with a wide network of global and local companies.

- No restrictions on financial transfers: Freedom to transfer profits and capital abroad, without restrictions on currency or money transfer.

- Promotional programs and incentives: Support programs and financial incentives that encourage investment and expansion in commercial activities.

In conclusion, Dubai Free Zones are a strategic investment option that enhances growth and expansion opportunities for businesses. Thanks to their advanced business environment, tax benefits and exemptions, full foreign ownership, and modern infrastructure, these regions provide excellent opportunities for local and international investors. The diversity of permitted business activities, ease of establishment procedures, and comprehensive services provided make Dubai an ideal destination for companies wishing to enter global markets and expand their operations. Therefore, investing in a free zone in Dubai does not only represent a step towards achieving commercial success, but it is an investment in a promising and prosperous future.

The most important frequently asked questions about Dubai Free Zone

What types of business activities are allowed in the Dubai Business District (DIFC)?

Includes financial, legal, and advisory activities, in addition to related services.

Can companies in free zones benefit from government support programs?

Yes, there can be support programs and incentives from the government to encourage investment and growth.

What are the added benefits of investing in Dubai Technology and Media District (DIC)?

It provides a suitable environment for technology and media companies with modern infrastructure and industry-specific facilities.

What is the difference between free zones and non-free zones in Dubai?

Free zones offer full foreign ownership and tax exemptions, while non-free zones may require a local partner and be subject to local taxes.

Can companies in free zones deal with the local market?

Yes, it can, but you may need to register in Dubai or obtain additional licenses.