Establishing a company in the United Arab Emirates is an important strategic step that requires careful consideration of the legal and regulatory terms and requirements. The UAE enjoys an open and stable economic environment, and is considered one of the most prominent investment destinations in the world thanks to its regulated and business-encouraging policies. To make the process easier to understand, I will present the conditions for opening a company in the UAE without focusing on individual points or technical details:

Opening a company in the UAE requires following a series of organized and legal steps, starting with determining the type of company suitable for your business. Available options include limited liability companies (LLC), sole proprietorships, public joint-stock companies, and foreign subsidiaries, as well as private economic activities such as handicrafts and professional services.

Foreign investors who wish to open a company in the UAE must ensure 100% ownership in many sectors, while providing the required documents as part of regulatory procedures. In addition, all new businesses must obtain the required licenses and permits from local authorities to legally conduct business activities.

The documents necessary to establish the company are an essential part of the process, as they include the company document (Memorandum of Association) that specifies the company’s structure, terms of its management, and distribution of its profits, in addition to certified copies of the passports of all shareholders and designated directors. Lease contracts must also be submitted for offices or industrial spaces that the company will use as its business headquarters.

Conditions for opening a company in the Emirates

Conditions for opening a company in the Emirates

Opening a company in the UAE requires compliance with a number of legal and regulatory conditions aimed at regulating and facilitating business operations in the country. Here is a comprehensive introduction to the conditions for opening a company in the Emirates :

Company type:

Investors must determine the appropriate company type for their business, which can include limited liability companies (LLC), sole proprietorships, public joint-stock companies, and foreign subsidiaries, as well as special economic activities such as handicrafts and professional services.

Foreign investor ownership:

The law in the UAE allows 100% foreign investor ownership in many sectors, especially in free zones and special economic zones.

Licenses and permits:

New companies must obtain the necessary licenses and permits from local authorities to practice commercial activities legally, and this varies based on the type of activity, location, and conditions for opening a company in the Emirates.

Required capital:

Some companies may require specifying a specific initial capital, while other companies may not require this, and this is taken into account according to the type and size of the company and the conditions for opening a company in the Emirates.

Required documents:

The documents necessary to establish the company include the company document (Memorandum of Association), which specifies the company’s structure, terms of its management, and distribution of its profits, in addition to certified copies of the passports of all shareholders and designated directors. Lease contracts must also be submitted for offices or industrial spaces that the company will use as its business headquarters.

Legal and financial advice:

It is highly recommended to obtain legal and financial advice from specialized local consulting offices before starting the company establishment process, to ensure compliance with local laws and regulations, and to avoid potential legal problems in the future.

Advantages of opening a company in the Emirates

Opening a company in the United Arab Emirates represents an important strategic step for investors, due to the many advantages that make it a preferred destination for business and investments. Here I will review some of the main advantages of opening a company in the UAE:

Open investment policies:

The UAE is considered one of the most attractive countries for business and investments thanks to its open investment policies, which provide foreign investors with opportunities to fully participate in the local economy with ownership of up to 100% in many economic sectors.

Advanced infrastructure:

The UAE includes a modern and advanced infrastructure that includes international airports, advanced sea ports, and integrated transportation networks, which facilitates effective access to regional and international markets.

Encouraging business environment:

The UAE provides an encouraging business environment represented by easy tax policies, as the UAE does not impose income taxes on companies in most sectors, which greatly attracts investors.

Advanced laws and judicial system:

The legal system in the UAE is efficient and transparent, providing a stable and reliable legal environment for businesses and protecting the rights of investors.

Economic Diversity:

The UAE has great economic diversity, allowing investors to choose from a wide range of sectors such as energy, tourism, technology, financial services, and education, which enhances growth and expansion opportunities for new companies.

Access to regional and global markets:

Thanks to its strategic location, the UAE is a major connection point for global trade, making it easier for companies to take advantage of business opportunities available in local, regional and international markets.

Costs of establishing a company in the UAE

Establishing a company in the UAE involves several major expenses including legal and administrative procedures that must be considered before starting the process. Company establishment costs are affected by multiple factors such as company type and size, and here are some key points to consider:

- legal procedures:

Preparing the company document (Memorandum of Association), which defines the company’s structure and objectives, and must be done in cooperation with a specialized law firm.

Pay registration fees to the Companies and Commercial Regulatory Authority, which depends on the type of company.

- Licenses and permits costs:

Obtaining the company’s commercial activity license, which varies according to the type of activity and location.

Costs related to establishing the company in a free zone or special economic zone, as these costs may be somewhat higher due to the additional privileges available.

- Administrative services costs:

The costs of preparing the accounts and financial reports necessary for submission to the tax and financial authorities.

The costs of renting offices or industrial spaces that the company uses as its business headquarters.

- Legal and financial consulting costs:

Legal and financial advice necessary to ensure full compliance with local laws and regulations, and avoid potential legal problems in the future.

Opening a company in the UAE requires careful planning and specialized consultation to ensure that procedures are implemented correctly and effectively, which contributes to building a strong foundation for the company’s success in the local and international market.

Areas of establishing a company in the Emirates

Establishing a company in the UAE opens doors to a wide range of business and investment opportunities in various sectors. Here is a comprehensive introduction to some of the areas in which companies can be established in the UAE:

Tourism and Hospitality:

Tourism is one of the most important economic sectors in the Emirates, as Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, Ajman and Umm Al Quwain attract millions of tourists annually. Companies can be established in this field, such as hotels, tourist resorts, and tourism logistics services.

Technology and Innovation:

Dubai is a leading technology and innovation center in the region, providing excellent opportunities to establish technology companies in areas such as smart applications, software solutions, and financial technology (fintech).

Financial and banking services:

Dubai plays a central role as a financial center for the region, making it an ideal place to establish companies in the areas of financial services such as investment, insurance, finance, and financial consulting.

Education and Training:

The UAE is witnessing an increasing demand for educational and training services thanks to the growth of its population and the increase in the number of students. Companies can be established in this field, such as private schools, educational centers, and online education platforms.

Energy and Infrastructure:

The UAE is working to diversify energy sources and develop infrastructure, providing opportunities to establish companies in the fields of renewable energy, civil engineering, and industrial infrastructure.

Health and Medical Care:

The UAE is witnessing an increase in demand for health services and medical care, making it an ideal environment for establishing companies in the fields of private hospitals, medical clinics, and medical technology.

Creative and artistic industries:

The UAE promotes cultural and artistic diversity, which encourages the establishment of companies in the fields of arts and entertainment, media production, and cultural marketing.

Laws for establishing a company in the Emirates

Establishing a company in the United Arab Emirates requires compliance with several laws and regulations that regulate business operations and define the necessary procedures for establishing companies legally and effectively. In this topic, I will review a set of main laws that investors must be aware of when they intend to establish a company in the Emirates:

- Federal Company Law:

The UAE Federal Company Law specifies many rules and regulations that companies must adhere to, including the types of companies permitted, the conditions for their establishment, and the scope of their activities. - Foreign Investment Law:

The UAE Foreign Investment Law regulates the conditions for foreign investors’ participation in the local economy, including ownership percentages and procedures required to obtain the necessary licenses. - Labor Law:

The UAE Labor Law stipulates the rights and duties of workers, in addition to the conditions of employment of workers and practical contracts, and companies must adhere to local labor requirements. - Tax laws:

Tax laws in the UAE include regulations related to taxes on companies and individuals, and companies must submit financial reports in the required form and adhere to financial disclosure requirements. - Intellectual property rights laws:

The UAE protects intellectual property rights through laws and regulations regulating the registration of patents, trademarks, and copyrights, which helps protect the intellectual property of companies and individuals. - Local regulations and the International Court in Dubai:

There are local regulations that govern the operations of companies in the Emirates, in addition to the International Court in Dubai that provides a specialized judicial platform for resolving commercial disputes.

Documents required to establish a company in the Emirates

If you are thinking about establishing a company in the United Arab Emirates, here is a comprehensive introduction to the documents required to complete this process successfully:

Company document (Memorandum of Association):

It is the document that specifies the type of company, its location, and its objectives. It also includes the distribution of capital and the names of shareholders and managers. It must be prepared and notarized by an authorized attorney.

Company registration form (Application Form):

You must fill out the official form provided by the Companies and Commercial Institutions Regulatory Authority in the relevant emirate.

Proof of identity of partners and directors:

Certified copies of passports or identity cards of partners and directors must be submitted.

Necessary licenses and permits:

Some economic activities may require their own licenses from competent authorities such as the municipality or other governmental bodies.

Necessary contracts:

Contracts relating to partners, directors, employees and other parties involved in the company must be prepared and signed.

Financial certificates:

A bank certificate is required proving the deposit of capital in the company’s account at the specified bank.

Registration fees:

The required fees must be paid to the Companies and Commercial Regulatory Authority.

Lease or Ownership Contract:

A copy of the lease or ownership document for the building in which the company will be located must be submitted.

Authorization of authorized person:

If a specific person is authorized to handle legal and administrative procedures on behalf of the company, an approved authorization document must be presented.

Additional permits if necessary:

Some economic activities may require additional permits from relevant government agencies or ministries.

The UAE provides a favorable and transparent legislative environment for establishing companies, which is represented by compliance with laws and regulations that ensure the smooth and effective conduct of business. Establishing a company in the UAE requires interacting with many different papers and documents, and adhering to internationally recognized legal and administrative standards.

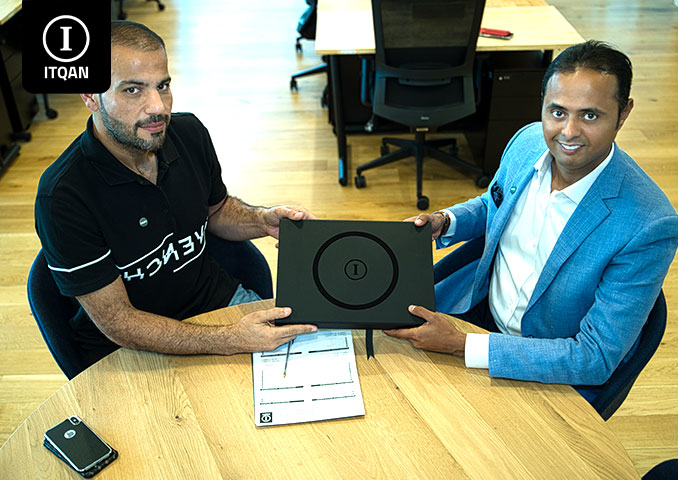

Our company’s role in opening a company in the Emirates

In a conclusion about the conditions for opening a company in the Emirates in cooperation with Itqan Company, it becomes clear that establishing a company in this country requires adherence to a set of legal and regulatory conditions that guarantee the success of the process in a legal and smooth manner. In cooperation with Itqan Company, the necessary expertise and consultations are provided to ensure full compliance with local laws and regulations, and to achieve the highest levels of professionalism in management and operation. Choosing a reliable consulting partner such as Itqan Company contributes to creating a strong foundation for the company’s success and achieving future goals with confidence and sustainability in the local and global market.

Frequently asked questions about the conditions for opening a company in the Emirates

What types of companies can I establish in the UAE?

Companies can be established in the Emirates of different types, such as the local company, the national company, the private company, the public company, and the company in a free zone or special economic zone.

What are the basic conditions for establishing a company in the UAE?

Conditions vary based on the type of company, but basic conditions include the presence of specific shareholders (partners), determining the necessary capital, and having a company headquarters in the Emirates.

What are the basic steps to establish a company in the UAE?

The steps include preparing the company document, registering it in the commercial registry, obtaining the necessary licenses from the relevant authorities, determining the company’s headquarters, opening a bank account, and registering for taxes if necessary.

What taxes apply to companies in the UAE?

The UAE has a favorable tax policy as there is no corporate income tax in most sectors. But there is a value added tax (VAT) that applies to some services and goods.

What languages are accepted for legal documents?

The official language of documents in the UAE is Arabic, but official translations into English can also be provided in some cases.